Driving drug competition to lower cost

In any industry, competition often leads to lower prices—period.

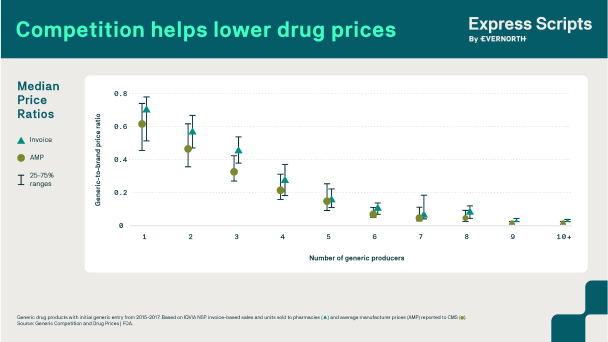

In the U.S. pharmaceutical market, drug manufacturers can—and do—increase prices to what the market will bear for drugs that have no competition, and charge lower prices for drugs where there is robust competition. PBMs like Express Scripts are more effective in negotiating discounts when there is greater competition among prescription drugs.

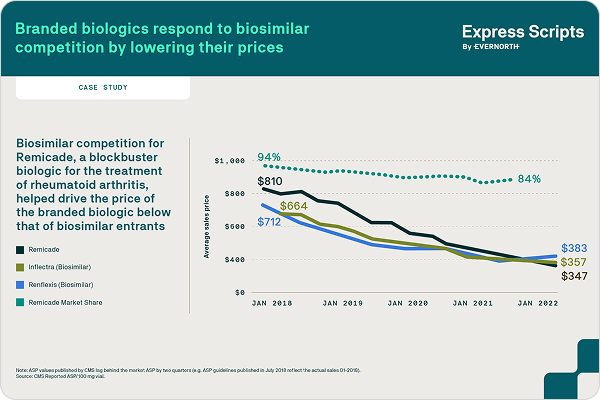

In the biosimilar landscape for example, biologics have little direct competition, largely due to patent litigation with biosimilar manufacturers. Having multiple competing products—whether another branded drug, multiple generics or a biosimilar—with equivalent patient benefits on the market allows PBMs to drive drug manufacturers to compete and provide patients and plan sponsors with access to lower cost drugs.

PBMs drive drug competition by:

Using formulary placement to prefer drugs that drive the lowest net costs

Implementing drug utilization management programs that encourage the adoption of lower-cost, clinically equivalent options

Developing products and solutions that incentivize utilization of lower-cost products

Encouraging pharmacies to dispense lower-cost alternatives where appropriate

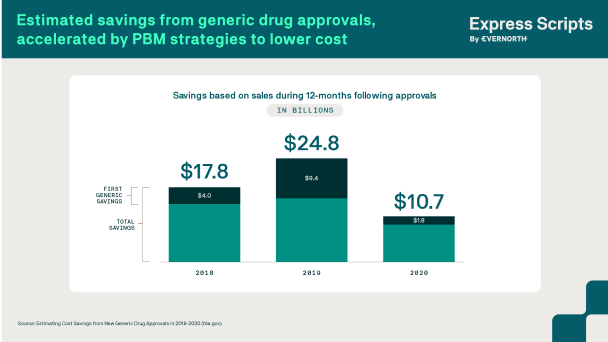

PBMs use generic and biosimilar competition to accelerate lower drug costs

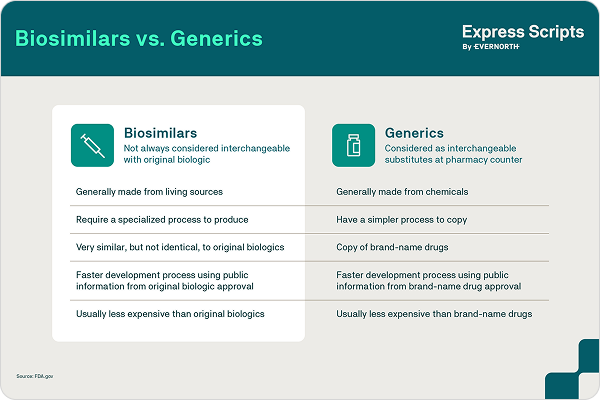

Once medications lose their patent protection, new, less costly options may become available in the form of generics and biosimilars. While PBMs have been using generic competition for decades to lower drug costs, biosimilars are relatively new in the marketplace. Biosimilars are clinically equivalent, lower-cost versions of biologics, which are complex medications made from natural and living sources.

Biosimilars vs. Generics

A recent Evernorth analysis estimates that biosimilar competition can save the U.S. $225 billion to $375 billion in pharmacy spend over the next decade.1

Capturing the biosimilar opportunity to lower costs

In 2021, biologics accounted for $260 billion of U.S. prescription drug spending, or 46% of total spend.2 For many years, the biosimilar market has been slow to develop, primarily due to resistance from pharmaceutical manufacturers—resulting in limited commercial availability and uncertain pricing dynamics.

The importance of interchangeability

Unlike most generics, biosimilars are not automatically designated as interchangeable upon FDA approval. If a patient is prescribed a branded drug that has a generic alternative, pharmacists can generally automatically substitute the lower-cost generic at the pharmacy counter. However, for biosimilars, the pharmacist would have to wait until the original biologic has a designated interchangeable biosimilar alternative in order to substitute the lower-cost alternative at the point of sale.

How competition and an interchangeable biosimilar are changing the insulin market

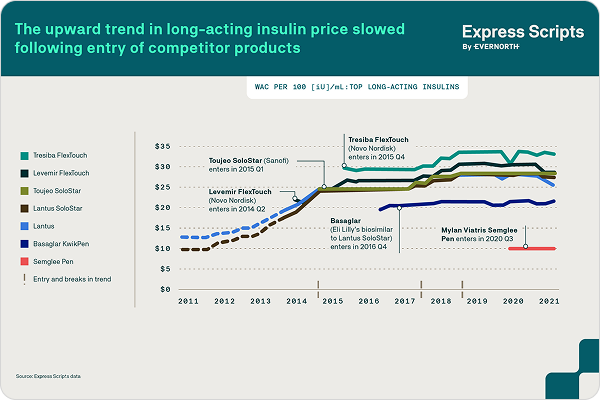

The long-acting insulin pen injector Lantus was launched in 2010 with a high list price that more than doubled over 2010-2014, with limited rebates. In 2015, competition entered the market and subsequently Lantus’ price increased only modestly year-over-year and rebates substantially increased.

Express Scripts announced in October 2021 that Semglee®, an interchangeable biosimilar with Lantus®, would be available as a preferred product on our National Preferred Formulary. Semglee® is paving the way for automatic substitutions in certain states, where pharmacies can automatically dispense the lower cost product, but only to the extent those states’ laws allow.

Ensuring a robust biosimilars market

Pharmaceutical manufacturers seek the highest price point possible and many use loopholes in patent laws to maintain monopoly status for their branded products beyond original patent expiration dates, including:

1. Patent thickets

Blocking biosimilar and generic drug-makers from competing with lower-priced alternatives

2. Pay-for-delay

Agreements between manufacturers to delay biosimilar and generic drugs from coming to market

3. Product hopping

Marketing new versions of a drug incorporating only incremental innovations (e.g. extended release formulations) with the goal of thwarting patients’ ability to get lower-priced biosimilar and generic drugs

Sources

- Based on an Evernorth analysis of Express Scripts Drug Trend Report and IDP Analytics data to model the savings opportunity of 17 widely used biologic medications with patents expected to expire by or before 2030, with the assumption that at least one biosimilar for each reference biologic will be available in the market one year after patent expiration or at the end of exclusivity, whichever is later.

- "Biosimilars in the United States 2023–2027,” The IQVIA Institute for Human Data Science, January 31, 2023.

- Express Scripts. Internal Data. 2022

- Bates White Economic Consulting (May 31, 2023) "WAC and net prices for insulin Rx" Analyses based on data provided by Express Scripts