While pharmacy benefit manager (PBM) rebates are frequently blamed by drugmakers for the increasing list prices of long-acting insulin medicines which treat type 1 and type 2 diabetes, new insights from Express Scripts, Evernorth’s PBM, has found that the opposite is true.

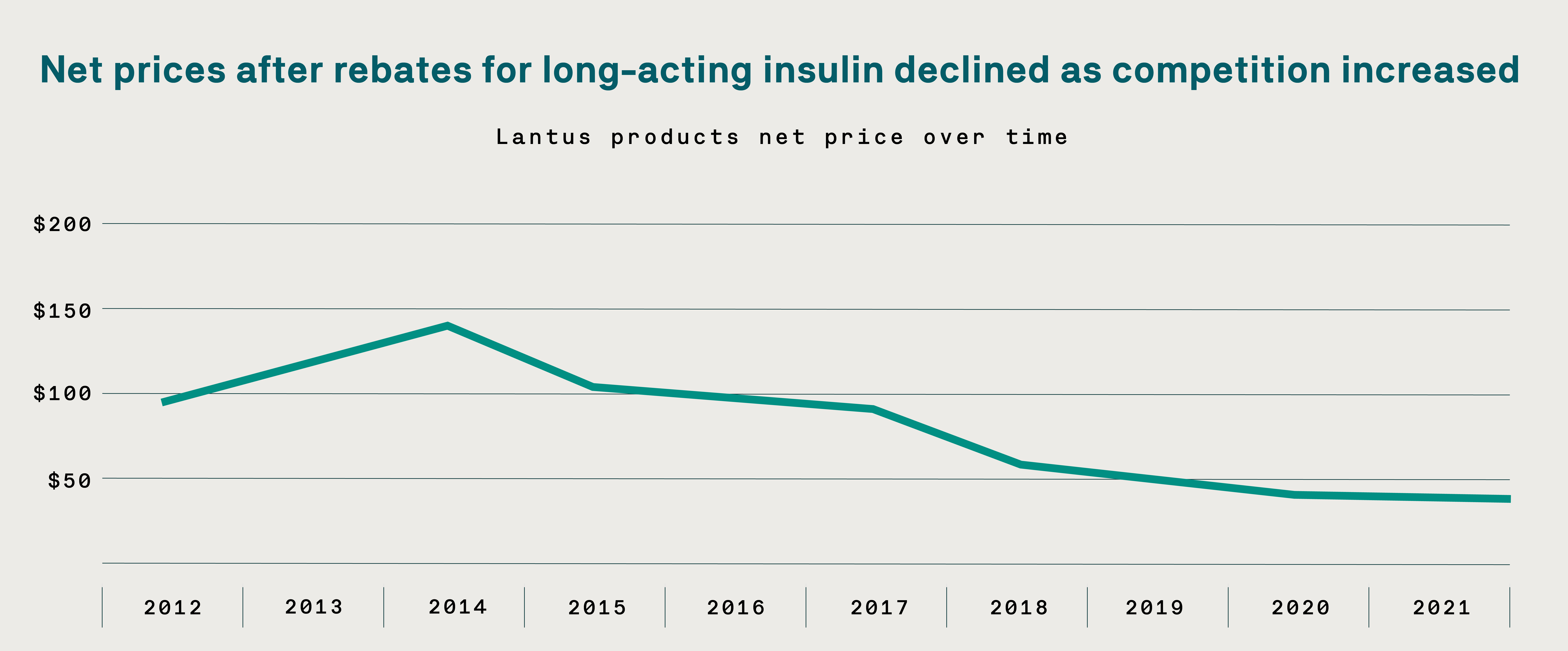

A recent analysis of Express Scripts data on historical wholesale acquisition costs (or list prices) of long-acting insulin biologic medications also found that the increased competition of insulin medications, including biosimilars, correlated with lower increases in list prices and greater rebate levels, resulting in lower net prices to health plans. In fact, the highest list price increases occurred during a period when rebates were at extremely low levels.

The greatest price increases occurred when rebates were at their lowest

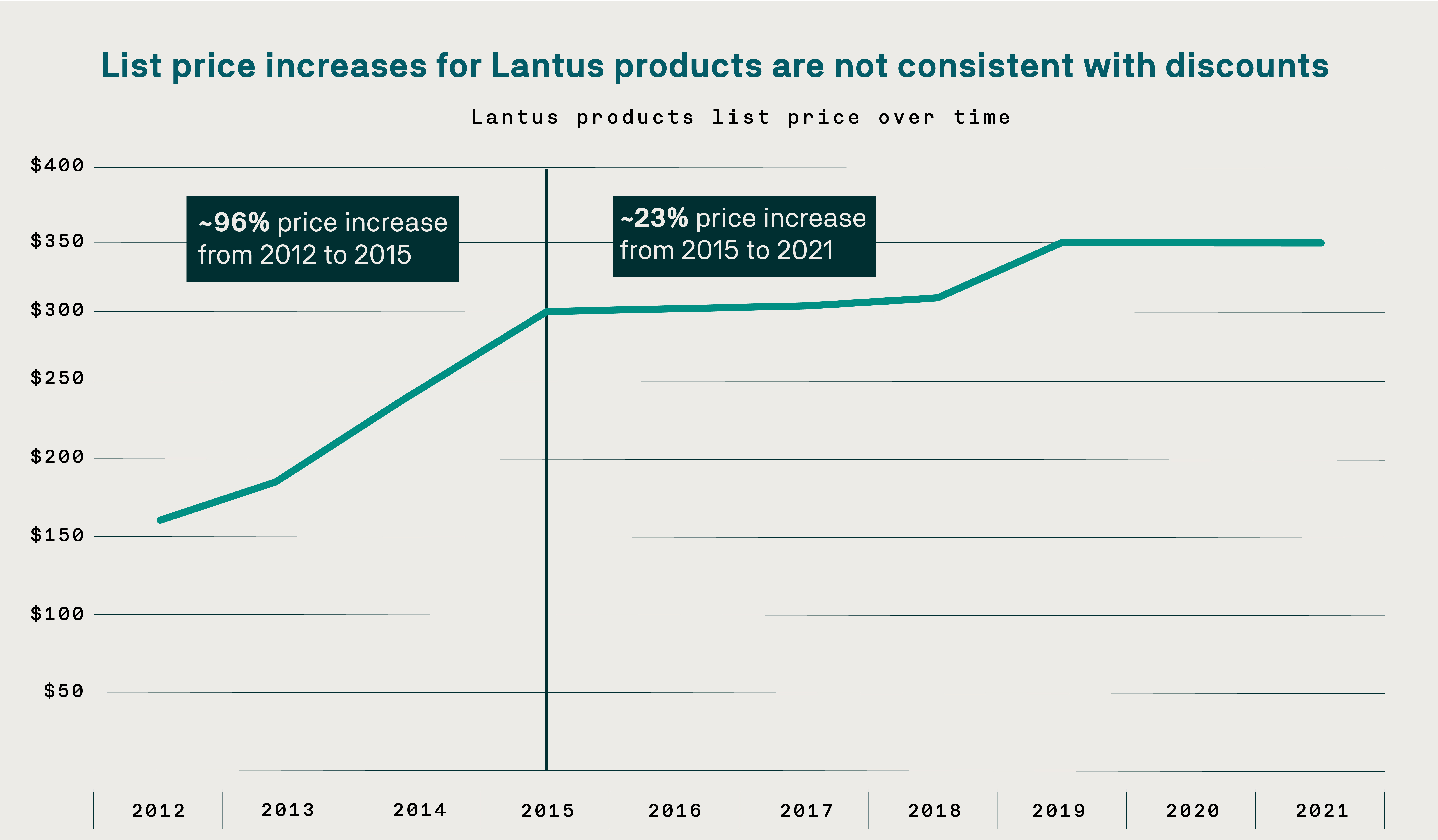

The analysis also reviewed Sanofi’s disclosure of list prices from 2012 to 2021 for the long-acting insulin biologic Lantus. From 2012 to 2014, list prices increased substantially while during this time the ability of Express Scripts to negotiate rebates was extremely limited (due to a lack of clinically viable alternatives). From 2015 to 2021, PBM rebates increased substantially, while the list prices rose only by a modest amount. These pricing patterns are inconsistent with pharmaceutical industry claims that PBM rebates drive higher list prices.

Click here to view a larger version of this graph. Source: The Sanofi 2023 Pricing Principles Report, corroborated by Express Scripts data.

During a period where limited rebates were available (from 2012 to 2015), Lantus prices nearly doubled, with an increase of approximately 96%.

In comparison, once Express Scripts was able to obtain greater rebates due to increased competition in the insulin category (from 2015 to 2021), Lantus prices increased more slowly – roughly 23% during this period.

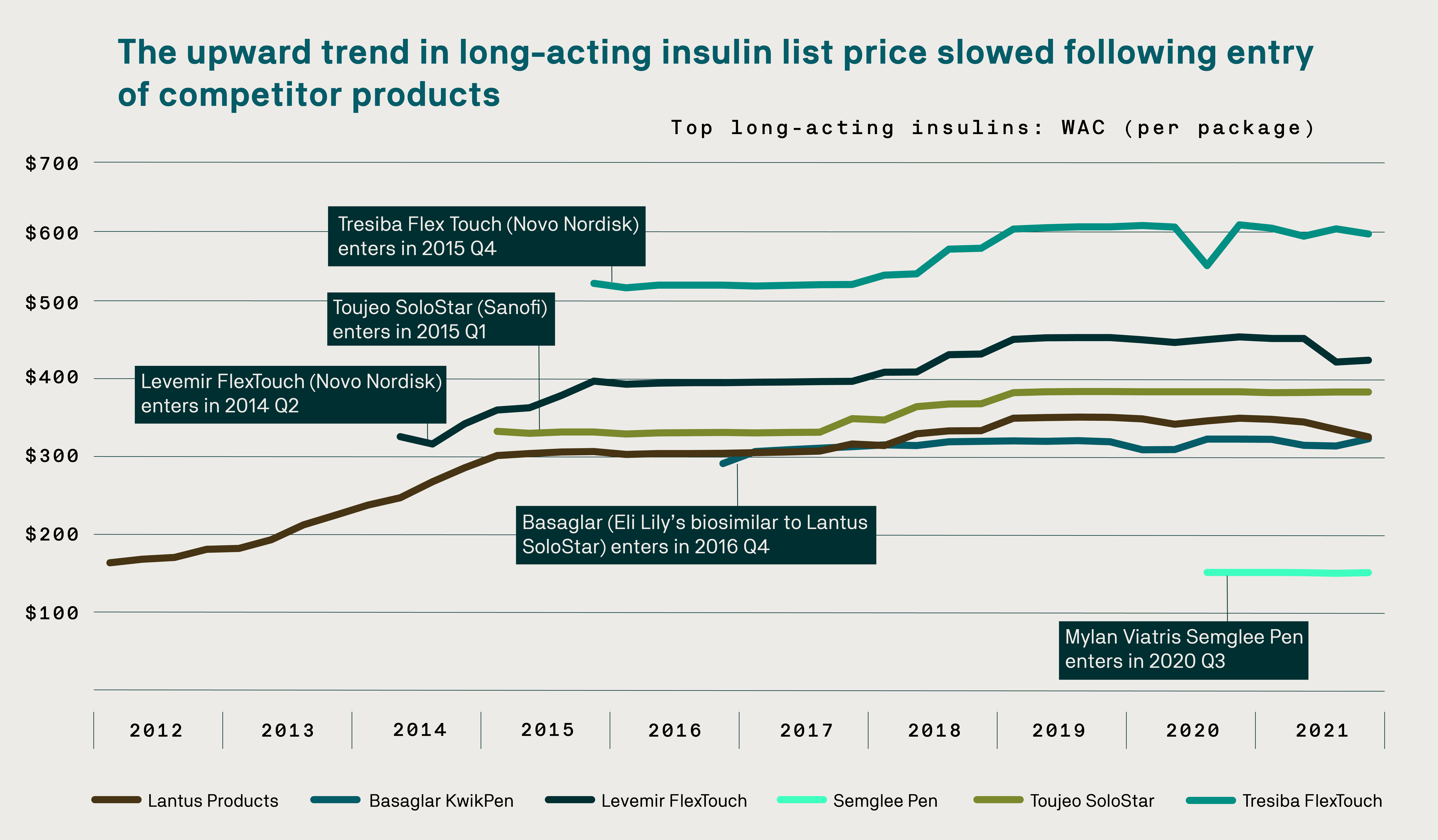

Competition helps keep prices in check

Lantus’ rapidly increasing price trend started to slow when new long-acting insulin products, including biosimilars, entered the marketplace. While the list prices of Lantus continued to increase – albeit at a slower rate – net prices after PBM rebates actually declined.

Click here to view a larger version of this graph. Source: Express Scripts data.

Click here to view a larger version of this graph. Source: Sanofi 2023 Pricing Principles Report.

Driving lower net cost for long-acting insulin treatment options

Competition among drug manufacturers is vital for lowering the costs of all medications, including insulin. Express Scripts fosters competition by adding clinically viable alternatives to its formularies, including biosimilars that have competitive net costs, which help drive long-term cost savings for their clients and members.

Express Scripts focuses on clinical effectiveness and safety – not cost – as the foremost consideration when developing a standard formulary. When two products are equally effective and safe, ESI encourages competition between manufacturers to help drive lower net costs for medications.

A continuing commitment to affordability

In addition to working to lower net costs for clients, Express Scripts helps patients enrolled in its clients’ benefit plans manage their out-of-pocket costs. When it launched the Patient Assurance Program, Express Scripts became the first PBM to implement a cap on out-of-pocket costs for insulin medications, ensuring that eligible patients in participating plans would pay a maximum of $25 for a 34-day supply, or $75 for up to a 90-day supply. These discounts are conveniently integrated into the patient’s benefit plan, without the need of having to obtain and apply coupons at the pharmacy counter. The program launched in 2020, well before government mandates and similar actions by manufacturers. Since then, the program has resulted in more than $200 million in total patient savings.

Today nearly two-thirds of Express Scripts members pay $35 or less for their insulin at the pharmacy counter, either through the Patient Assurance Program, their benefit design, or both.

“Express Scripts’ Patient Assurance Program was the result of collaborative negotiations with insulin manufacturers, and it has significantly improved adherence to these medications and clinical outcomes,” said Harold Carter, Chief Pharma Trade Relations Officer at Express Scripts. “Today and going forward, Express Scripts continues to advocate for our clients and their members, whether by adding biosimilars to our formularies, continuing to drive to lower competitive costs, and by taking other appropriate steps to make medications more affordable.”