In any industry, competition is the linchpin for driving down prices, and the U.S. pharmaceutical market is no exception. Left unchecked, drug manufacturers often escalate prices for their products to the maximum that the market can bear until competitors emerge.

Whether the competition involves branded medications intended for the same condition or pits brands against their generic or biosimilar equivalents, pharmacy benefit managers (PBMs) like Express Scripts leverage the availability of alternative products to negotiate price discounts.

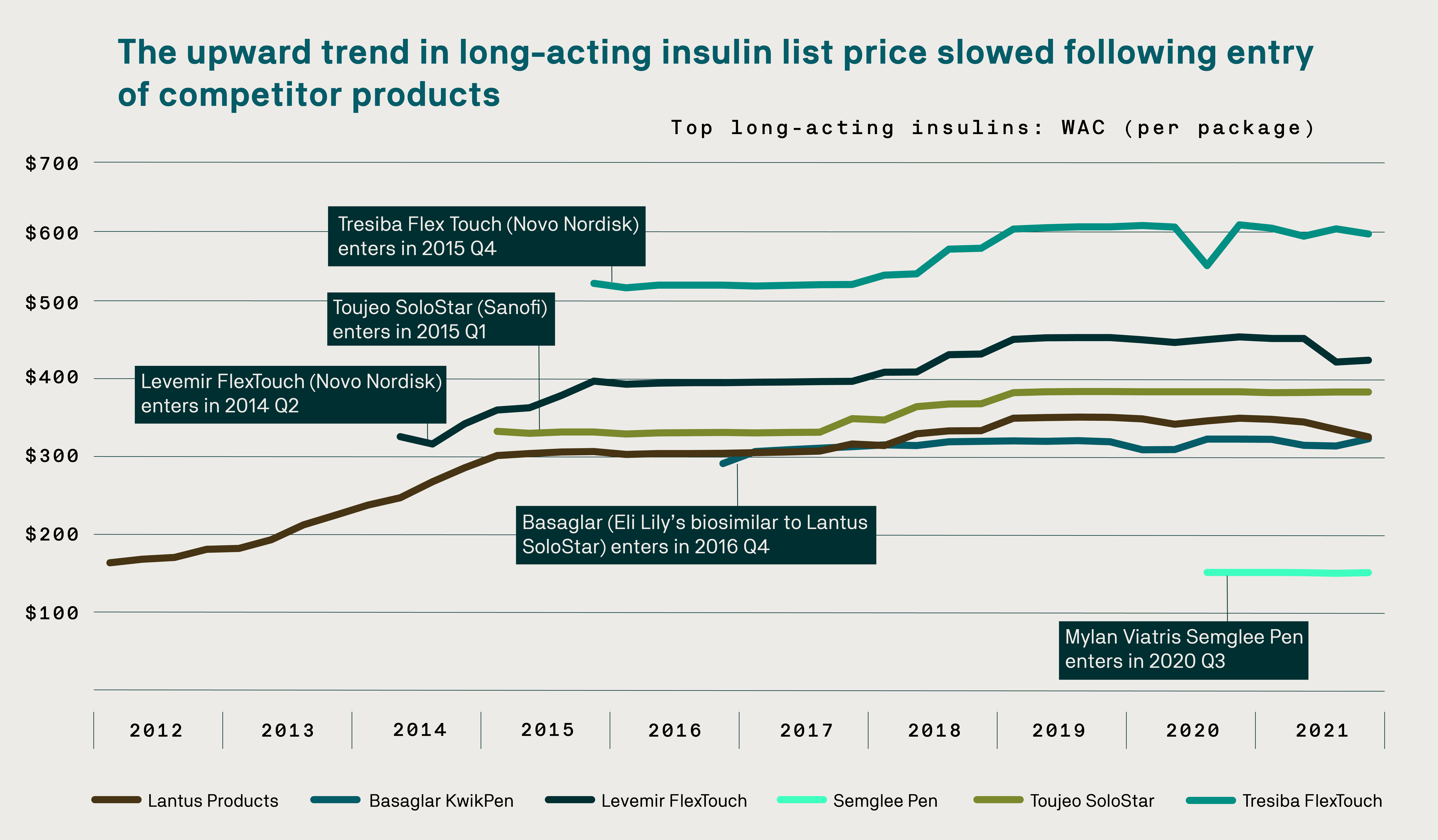

Today, biosimilars are at last disrupting a marketplace that for too long faced little to no competition. For example, the list price of the biologic Lantus, a long-acting injected insulin, more than doubled during its first five years on the market. The introduction of competing products, including multiple biosimilars and the first interchangeable option, led to a decrease in Lantus’ price.

Click here to view a larger version of this graph. Source: Express Scripts data.

Historically, biologics have represented only 2% of the drugs on the market yet accounted for 37% of total drug spend in the United States. Much of that spending was driven by AbbVie’s Humira, used to treat certain autoimmune diseases, including rheumatoid arthritis, plaque psoriasis, and Crohn’s disease.

Over the two decades following its FDA approval, Humira became the most prescribed medication worldwide. It also became more and more expensive, with its list price rising nearly 500% between 2003 and 2021. The entrance of biosimilars in the past few years, including the availability of the first high-concentration interchangeable Simlandi, led to Humira’s effective price decreasing by an estimated 38%, with 2024 being the first year that Humira didn’t come with a list price increase. As more competition emerges in the drug market, the inflammation and immunology sector is expected to see the most substantial slowdown in price increases over the next five years.

“As more brand-name biologics lose exclusivity and as biosimilars continue to enter the market, there is significant opportunity for PBMs to drive substantial savings for plan sponsors and their members,” said Jeremy Fredell, chief pharma trade relations officer at Express Scripts. He cited Evernorth data that projects nearly half of the top 25 specialty drugs in the U.S. to have biosimilar and generic equivalents by 2030, which would open up an additional estimated $100 billion in annual drug spend to competition.

Empowering plan sponsors to support the next wave of drug innovation

The savings generated by this heightened competition from biosimilars can offset the costs of supporting other drug innovations, Fredell said. “Plan sponsors will have financial headroom to afford coverage for breakthrough medicines, like GLP-1s for diabetes and obesity, as well as million-dollar gene therapies,” he said.

GLP-1s accounted for nearly a quarter of non-specialty drug spend in 2023, according to Evernorth data. By 2030, the market is expected to exceed $100 billion, with an estimated 30 million people – roughly 10% of the U.S. population – projected to use these drugs.

Gene therapies are experiencing a massive acceleration of innovation, with up to 20 new gene therapy launches expected annually starting in 2025. By the end of 2034, more than 1 million patients are projected to receive gene therapies each year, at a cost exceeding $25 billion annually.

“Beyond driving competition and lowering costs, the rise of biosimilars has the potential to reshape the pharmaceutical landscape by enabling plan sponsors to offer the next wave of innovative drug treatments to their members,” Fredell said.

Streamlining access to biosimilars

Express Scripts has long been committed to elevating the use of effective and affordable biosimilars. In 2022, it added Semglee, the first interchangeable insulin product, to its National Preferred Formulary, driving more than $20 million in savings for plan sponsors in just one year. The company plans to remove Humira from commercial formularies in 2025 to drive competition and lower costs while ensuring seamless patient care with the availability of multiple interchangeable biosimilars.

Fredell stressed that cost is the last item taken into account when considering a biosimilar for drug formularies. “First we check each biosimilar’s clinical efficacy, safety, interchangeability, available supply, dose, and concentration,” he said, adding that this clinical-first approach ensures a positive, seamless patient experience with more affordable drug options.

By continuing to foster competition with effective biosimilars, Express Scripts can further bend pharmaceutical cost trends for plan sponsors, supporting savings today and drug innovation in the future.